Customer Lifetime Value (CLV): Use predictive analytics to forecast the total value of a customer over time

CLV predicts customer value, while predictive analytics refines estimates for better targeting and retention.

Customer Lifetime Value (CLV) is a metric that represents the total revenue or profit a business can expect to generate from a customer throughout their entire relationship with the company. In simpler terms, it answers the question: How much is a customer worth over the long term?

Importance for Marketers:

Knowing Customer Lifetime Value is crucial for marketers for several reasons:

Resource Allocation: Understanding CLV allows marketers to allocate resources better. If a business knows which customers are likely to be the most profitable over time, then managers can focus on retaining and nurturing those customers rather than constantly acquiring new ones.

Customer Retention Strategy: It helps marketers focus on retaining high-value customers, since it's often cheaper to keep an existing customer than acquire a new one. With this knowledge, marketers can tailor retention efforts (such as loyalty programs, personalized offers, or customer service improvements) to the right segment of their customer base.

Segmentation and Personalization: By calculating CLV, marketers can segment customers into groups based on their profitability. This allows for more personalized marketing campaigns and pricing strategies, improving the overall customer experience.

Cost of Acquisition (CAC) Evaluation: CLV is essential for evaluating the effectiveness of marketing campaigns. When marketers know the CLV of different customer segments, they can compare it with the Customer Acquisition Cost (CAC). Ideally, CLV should significantly exceed CAC for a business to be sustainable.

Forecasting and Business Strategy: CLV helps businesses project future revenue, make data-driven decisions, and set long-term goals. It gives insight into how changes in customer acquisition, retention, and spending habits will affect overall financial performance.

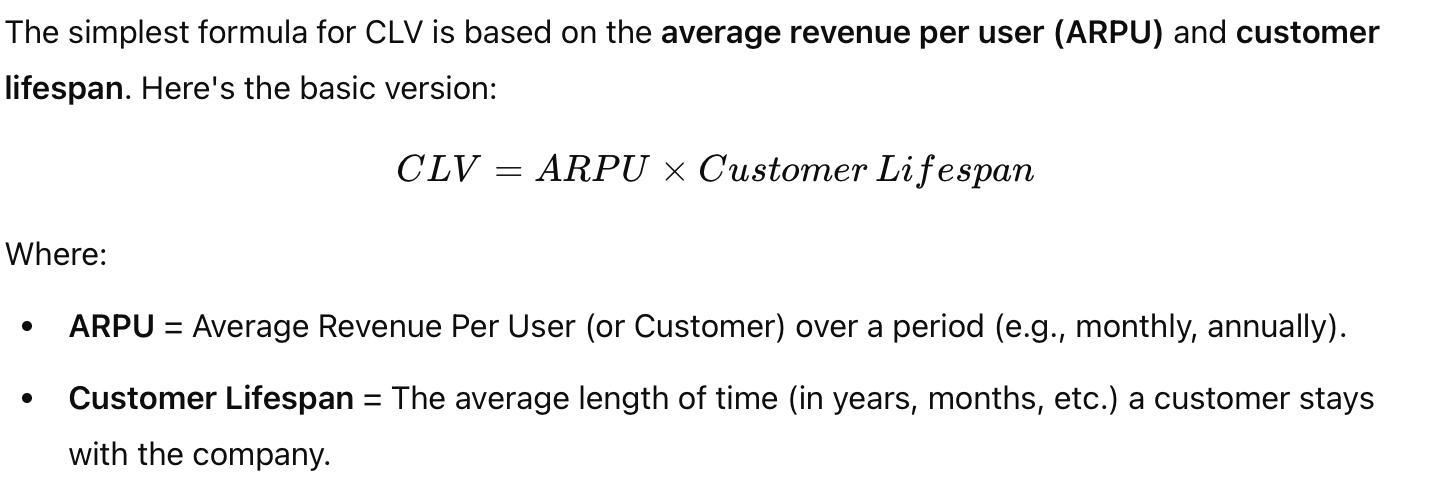

Formula for Customer Lifetime Value:

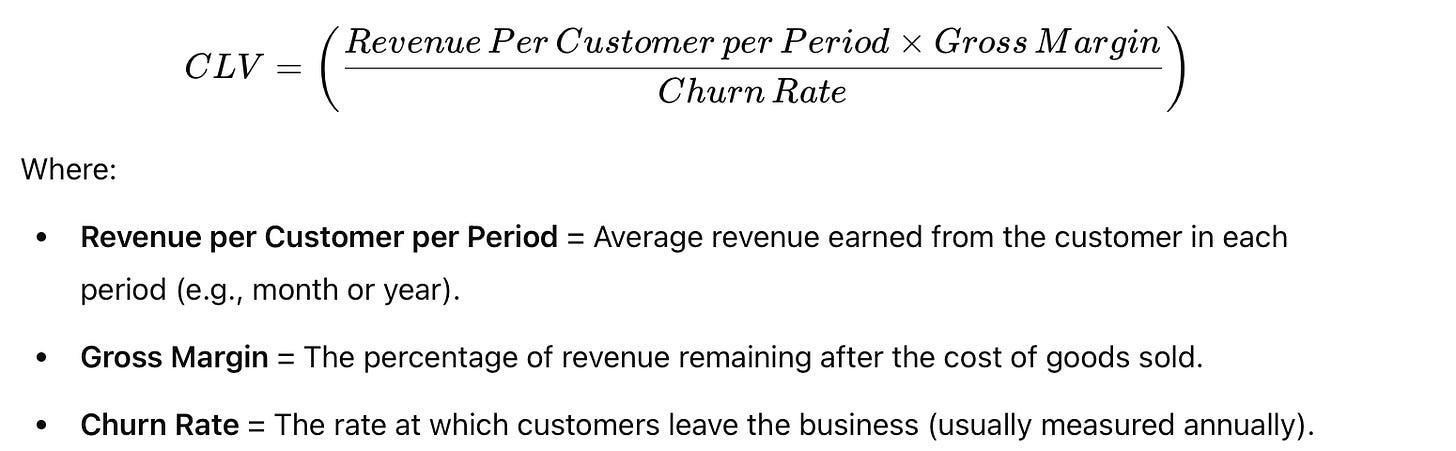

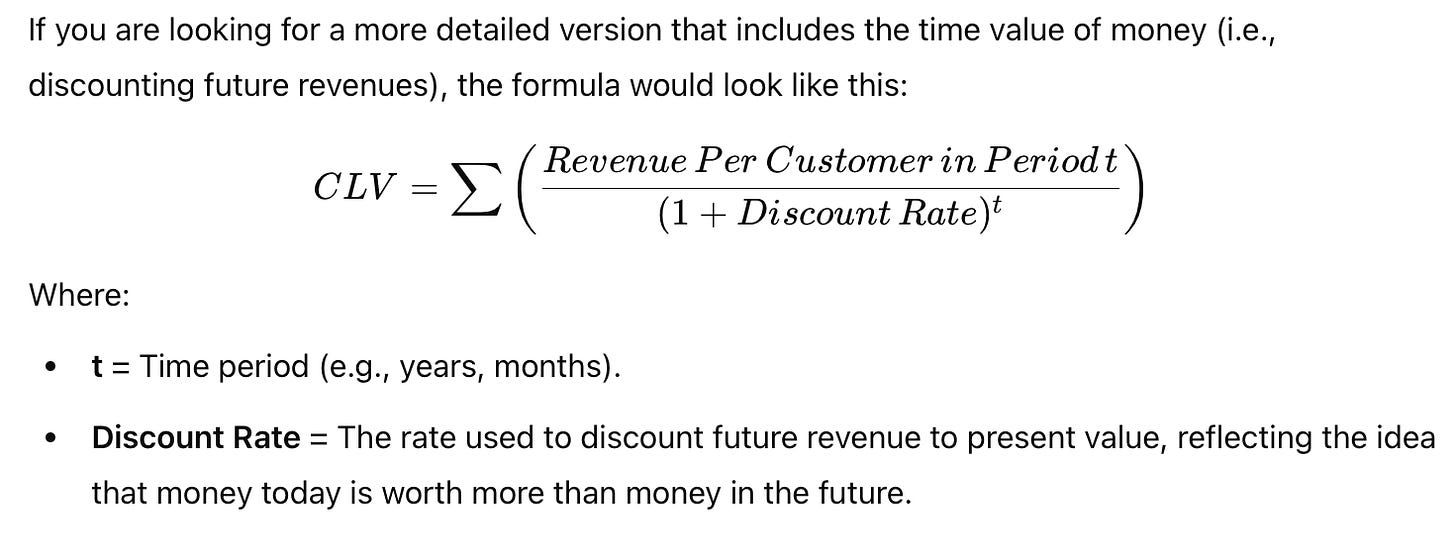

However, to make it more comprehensive, you can consider profit margins and discount rates. The formula then becomes:

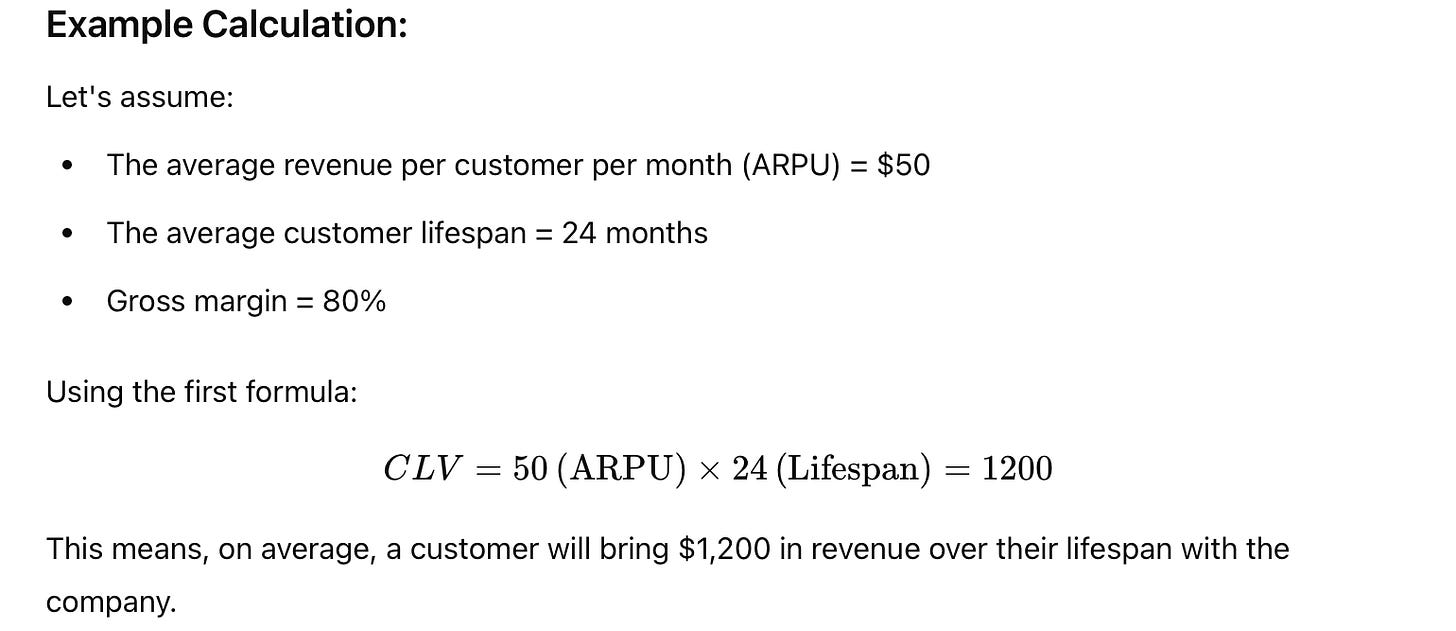

If you're using a more advanced formula, like the one with churn rate or profit margins, you could refine this number further, especially in subscription-based businesses where retention is a critical factor.

Predictive analytics can be a powerful tool in assessing Customer Lifetime Value (CLV) because it enables businesses to forecast future behavior based on historical data, trends, and patterns. By leveraging advanced statistical techniques, machine learning models, and data mining, predictive analytics can provide more accurate and dynamic CLV predictions, especially when compared to simple historical or average-based models. Here’s how predictive analytics can be helpful in assessing CLV:

1. Accurate Prediction of Future Revenue

Predictive analytics can take into account various factors that influence a customer’s future behavior, such as purchase frequency, average order value, seasonality, and engagement levels. By analyzing these factors, businesses can estimate the total revenue that a customer is likely to generate over their relationship with the company, which results in a more refined and accurate CLV prediction.

How it works:

Machine learning algorithms (like regression analysis or decision trees) can analyze past customer behavior and predict how long they are likely to stay, how much they will spend, and the probability of them making future purchases.

For example, if a customer has made consistent purchases over the last 6 months but suddenly shows signs of churn (e.g., lower engagement), the model might predict that their future revenue will decline.

2. Incorporating Churn Prediction

One of the critical challenges in CLV modeling is customer churn—predicting when a customer might leave or stop purchasing. Predictive analytics can significantly improve churn prediction, helping businesses estimate CLV more precisely. By analyzing patterns such as purchase frequency, customer complaints, or negative sentiment, businesses can identify customers who are at risk of churning, and adjust their CLV forecasts accordingly.

How it works:

Predictive models can calculate churn probability for each customer using factors such as customer engagement, satisfaction scores, and product usage.

By incorporating these predictions into CLV calculations, businesses can better understand which customers are likely to remain loyal and which ones may stop generating revenue prematurely.

3. Personalized CLV Estimates

Predictive analytics allows for more granular, individualized CLV predictions rather than relying on an average estimate for all customers. This is especially useful for businesses with diverse customer segments or those offering personalized products and services. By segmenting customers based on their behavior, preferences, or demographics, predictive models can calculate a more accurate CLV for each segment or individual customer.

How it works:

Predictive models segment customers based on factors like purchase history, demographics, or even behavioral data (e.g., browsing habits, cart abandonment).

The model can then generate different CLV predictions for each group, allowing businesses to tailor marketing efforts to high-value customers while reducing spend on lower-value ones.

4. Dynamic CLV Calculation Over Time

Traditional CLV models often assume a constant rate of purchase and customer lifespan, but in reality, customer behavior evolves over time. Predictive analytics can continuously update CLV predictions as new data comes in, allowing businesses to adjust their strategies as customer behavior changes.

How it works:

Machine learning models can be trained to adapt over time, recalculating CLV as new interactions (e.g., purchases, support tickets, marketing responses) are logged.

For example, if a customer recently increased their spending or engagement with the brand, the model can immediately adjust the predicted CLV upward.

5. Identifying High-Value Customer Profiles

Predictive analytics helps in identifying the characteristics of high-value customers, which can be crucial for improving customer acquisition strategies. By analyzing data on past customers who had a high CLV, predictive models can identify common traits (e.g., demographic, behavioral, or transactional) that correlate with long-term profitability.

How it works:

Predictive models use clustering techniques (like k-means clustering) or classification algorithms to identify groups of customers with similar high-value characteristics.

This insight allows businesses to target similar prospects in future marketing campaigns, improving the likelihood of acquiring customers who are more likely to generate high CLV.

6. Optimizing Marketing Campaigns

By forecasting the future value of customers and predicting their likelihood of converting, retaining, or churning, predictive analytics allows businesses to design more effective marketing campaigns. Marketers can focus their efforts on customers who have a higher potential for long-term value, as opposed to spending resources on low-value customers.

How it works:

Predictive models can segment customers based on predicted CLV and likelihood to respond to certain marketing initiatives (e.g., email campaigns, offers).

Businesses can then allocate marketing spend efficiently, targeting high-value customers with tailored offers or retention campaigns, and adjusting marketing spend on low-potential customers accordingly.

7. Advanced Pricing and Upselling Opportunities

Predictive analytics can help businesses forecast when customers are likely to make larger or more frequent purchases. This can provide insights into the optimal time for upselling or cross-selling opportunities, boosting the overall CLV.

How it works:

Predictive models can anticipate which customers are most likely to respond to upsell or cross-sell offers based on their historical behavior and preferences.

By targeting these customers with relevant offers, businesses can increase the average revenue generated per customer, thereby increasing CLV.

8. Refining Customer Segmentation

With predictive analytics, businesses can move beyond simple demographic-based segmentation and create behavioral or value-based segments that are more aligned with long-term profitability. By continuously analyzing customer data, predictive models can identify emerging segments that may have high potential for CLV.

How it works:

For example, a predictive model might reveal that a certain group of customers who engage with content on social media (but have not yet purchased) are more likely to convert and generate high future value. Marketers can use this data to target similar prospects.

Key Predictive Techniques for CLV:

Logistic Regression & Survival Analysis: These techniques are often used for churn prediction, helping predict whether a customer is likely to stay or leave based on past behavior and demographics.

Random Forest & Gradient Boosting: These machine learning techniques can predict future customer behavior by considering multiple variables, providing a robust CLV estimate even in complex datasets.

Time Series Analysis: Time-based patterns, such as seasonality or trends in customer purchases, can be incorporated into CLV models, providing a more accurate forecast of future revenue.

Neural Networks & Deep Learning: These can model complex, non-linear relationships in data, offering highly accurate predictions for customer behavior and CLV, especially in large datasets with a lot of interaction factors.

Conclusion:

Understanding and calculating Customer Lifetime Value gives marketers the insights they need to drive customer-centric strategies, maximize long-term profitability, and ensure that the business invests wisely in customer acquisition and retention.